The Most Important Variable Investors Ignore

Summary:

Time horizon is a decisive factor in shaping investment outcomes

Portfolio rotation can interrupt the magic of compounding

Counter to prevailing wisdom, diversification is the antithesis of wealth creation

[four minute read]

“Our favorite holding period is forever.” —Warren Buffet

Introduction

In the short term, markets are driven by noise.

In the long term, they are driven by fundamentals.

Investors who understand the difference gain an enduring advantage.

Compounding

“Compound interest is the eighth wonder of the world.” —Albert Einstein

While there is no evidence to confirm Einstein actually said that, anyone investigating the algebra of compounding might reasonably conclude that he could have.

A penny doubling daily for 30 days turns into $5.0 million.

The world’s ten wealthiest individuals built their fortunes by compounding in a single company, not by chasing the next trade.

As investors, our primary objective should be to align capital with durable themes that allow it to remain invested over the long term.

The Case for Patience

“After spending many years in Wall Street and after making and losing millions of dollars I want to tell you this. It never was my thinking that made the big money for me. It always was my sitting. Got that? My sitting tight! —Jesse Livermore

$1,000 invested in Amazon’s 1997 IPO would be worth over $3.0 million today.

The success of Amazon may seem obvious in hindsight, but it wasn’t easy:

Dotcom bust—94% decline

Great financial crisis—64% decline

As recently as 2022—56% decline

Had an investor bought the 1997 IPO and sold the exact top in 1999 before the dot-com bubble burst, they would have turned $1,000 into $70,000.

A 70x return sounds great, until you consider that the same investment would be worth over $3.0 million today.

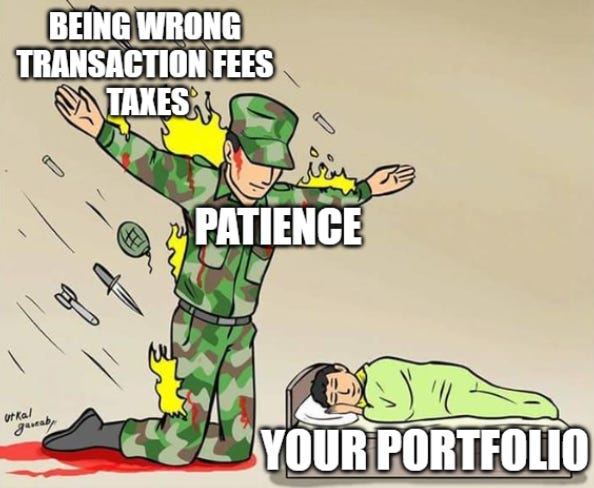

There are three primary drawbacks of portfolio rotation:

Being Wrong—every change we make is an opportunity to be wrong

Taxes—profit taking triggers tax liabilities that interrupt compounding

Transaction fees—transaction and execution costs erode returns

Concentration

“I like putting all my eggs in one basket and then watching the basket very carefully.” —Stan Druckenmiller

Modern Portfolio Theory emphasizes the importance of diversification as a fundamental strategy to manage risk and optimize returns.

Sounds reasonable, right?

100% disagree.

Diversification is the antithesis to wealth creation.

If we have done the work and are confident in our ideas, we should concentrate our bets to match the conviction of our conclusions.

If we diversify our investments across assets, we can at best expect to earn the market return.

Our focus remains squarely on outperforming the market.

Positive carry

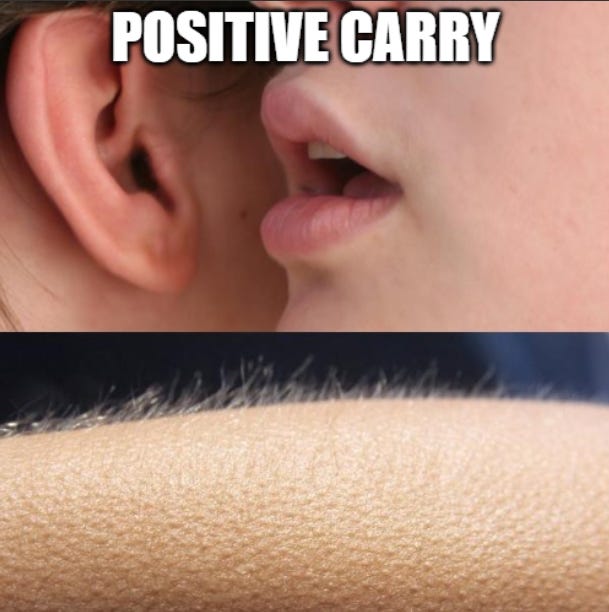

One way to tilt the odds in our favor is through positive carry—investments that pay you income to express your view.

If I can choose between buying vacant land or a fully leased apartment building, all factors equal I should prefer the apartment building.

The land carries costs for taxes and maintenance with no associated income.

The apartment building generates rental revenue that offsets expenses and distributes excess income to investors—positive carry.

Positive carry expands the scenarios in which we can generate a return.

Let’s assume several scenarios for an investment we make paying a 5% dividend:

Investment returns a gain—we achieve that gain plus 5%

Investment is flat—we still earn 5%

Investment is down 3%—we earn net 2%

Investment is down 7%—we only lose 2%

Positive carry dramatically improves our investment outcomes which are amplified when compounded over years or decades.

Changing your mind

“When the facts change, I change my mind. What do you do, sir?” —John Maynard Keynes

Compounding requires conviction, highlighting the importance of our research.

Short term price fluctuations are just noise, so long as they don’t change our long term thesis.

They may even present opportunities to add to our positions at attractive prices.

While disruptive, the 2008 financial crisis did not fundamentally change the investment thesis for Amazon.

A long time horizon, however, is not at odds with changing your mind.

I often see investors enter a position with a defined price target only to sell prematurely despite no change in the underlying thesis.

Worse still is clinging to a position after the thesis has failed in hopes of getting back to even.

What’s important is that we follow a process:

Deep research to establish a holding period and price target

Continually re-evaluate the thesis validity

If the thesis remains valid, stay the course

If the thesis changes, change our position

Conclusion

The two most established long term investment themes on my radar are:

Technological innovation

Currency debasement

I will cover both in future posts.

For now, the conclusion should be clear.

Think long term.