NOVAGOLD: Deeply Mispriced

How one gold mining stock could deliver 180% returns

Summary:

NOVAGOLD is one of the most compelling investments on my radar

Current prices suggest the potential for 180% gains

New gold discoveries add hidden value to my upside targets

[five minute read]

Introduction:

What’s your favorite stock right now?

I have a complicated relationship with this question.

On one hand, I spend a great deal of time studying markets and love sharing my ideas.

On the other hand, taking a stock tip from me or anyone else is a great way to set yourself up for failure.

You may know what I like, but you may not know how I’m positioned or how my position changes over time.

Intellectual flexibility is a defining feature of my process, and I change my mind often.

I may love an idea today and be completely out of the position tomorrow.

With that disclaimer out of the way, below is my investment thesis for NOVAGOLD.

About

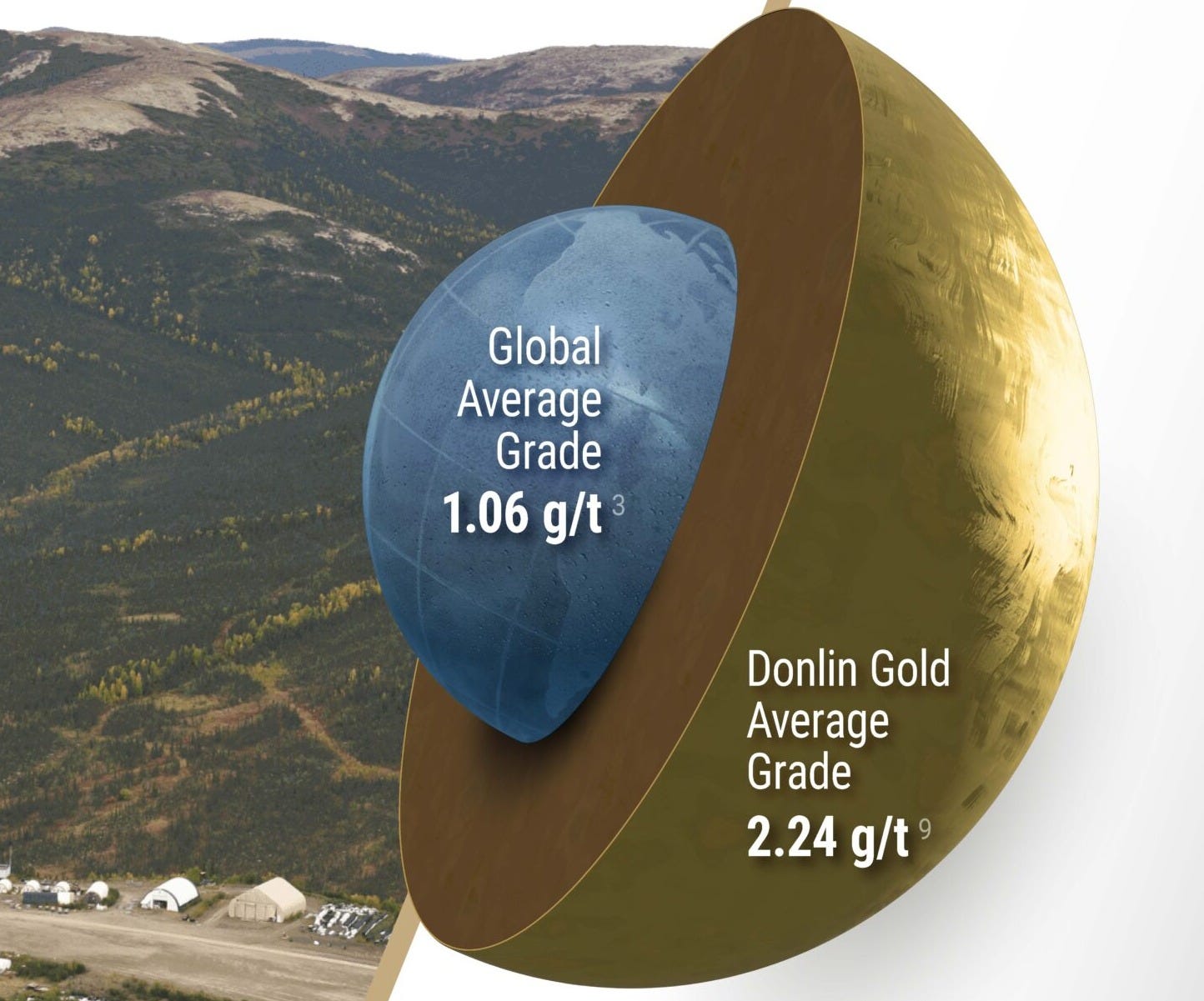

NOVAGOLD Resources, Inc. (NYSE: NG) is a development‑stage precious metals company exclusively focused on advancing the Donlin Gold project in Alaska, one of the world’s largest and highest-grade undeveloped open-pit gold deposits. S&P Global ranks Donlin as the 5th largest proven gold deposit on earth.1

Thesis:

Grade

At over twice the global average, Donlin is one of the highest grade large scale deposits ever discovered—enabling unparalleled extraction economics at scale.

Jurisdiction

Located in Alaska, Donlin sits in a low risk mining jurisdiction with rule of law, permitting clarity, and infrastructure support.

Management

Chairman Thomas Kaplan is the founding architect of NOVAGOLD, its largest shareholder (24% owner), and a self made billionaire who built his fortune in precious metals exploration & production—bringing decades of experience advancing tier one assets through development cycles.

Valuation

The market values NOVAGOLD at just 4% of the underlying gold in the ground, implying a significant valuation disconnect.

Capital Position

Strategic backing from billionaire John Paulson and access to capital markets removes financing as a binding constraint to advancing the project.

Potential to Discover More Gold

The most likely location to discover a new gold deposit is adjacent to an existing one. The Donlin deposit occupies only a small portion of NOVAGOLD’s owned land area, with active exploration underway.

Valuation

NOVAGOLD owns 23.4 million ounces of proven gold reserves at Donlin.

At current prices ($4,480/oz.), this equates to $105B of gold.

NOVAGOLD’s current equity valuation is just $4B, less than 4% of the gold value.

Due to the unique risks and significant capital expenditures needed to open and operate a mine, gold miners should trade at a discount to their gold holdings—but is a 96% discount appropriate?

Deeply Mispriced

There is no reliable asset based valuation rule of thumb. Even if there was, that type of valuation methodology would be too imprecise for me.

Net present value (NPV) is a more precise valuation methodology.

NPV is a fundamental approach to valuation that suggests fair value is equal to the sum of all future profits the company will generate.

Punchline for those who don’t like math:

I estimate NOVAGOLD’s fair value at $28/share, 180% above the current $10/share.

Math

For those who do like math and want to see my work:

NOVAGOLD projects Donlin will be operating by 2031 with a 27-year projected life.

NOVAGOLD projects 666,667 ounces of average annual gold production or roughly $3.0B annually at current gold prices ($4,480/oz.).

Assuming a 5% discount rate, this equates to a net present value (NPV) of $44B. This figure represents the revenue NPV.

Next, we need to back out expenses and calculate profit.

NOVAGOLD produced a technical report2 estimating expenses over the life of the mine as follows:

Mining operating costs = $8.4B

Processing operating costs = $6.9B

General & administrative costs = $1.8B

Royalty and land costs = $6.6B

TOTAL Expenses = $23.7B

NPV of revenues ($44B) minus NPV of expenses ($23.7B) = $20.3B NPV of profits.

One more adjustment is needed.

Since Donlin will cease production after 27 years, all capital expenditures associated with the project need to be fully depreciated over the life of the mine:

Upfront capex = $7.4B

Ongoing capex = $1.7B (over the life of the mine)

Total Capex = $9.1B

NPV of profits (from above) = $20.3B minus $9.1B in capex = $11.2B market cap.

An $11.2B valuation implies 180% upside from NOVAGOLD’s current $4B market cap.

Positioning

Today, NOVAGOLD is trading at $10/share. My work above suggests it could climb to $28/share in the years ahead.

This valuation implies that NOVAGOLD could eventually trade at roughly 11% of the net asset value of gold owned but not yet extracted. Seems reasonable.

I acquired my NOVAGOLD position for an average cost basis of $5/share. Will I hold my position until $28/share? Unlikely.

As NOVAGOLD climbs towards $20-30/share, I will likely exit my position.

Conclusion

In my article last week, I explained that precious metals are in a secular bull market but may be nearing a cyclical top.

Even if gold corrects in the short term, prices are likely to average significantly higher than current levels over the projected 27 year operating life of Donlin.

My $28/share price target assumes constant gold prices over 27 years. If gold prices continue to rise, NOVAGOLD shares should rise as well.

I rarely see investments with this degree of upside asymmetry.

One final point worth restating. The Donlin deposit sits on less than 5% of the total land area owned by NOVAGOLD. The most likely location to discover a new gold deposit is adjacent to an existing one, offering investors an embedded call option with significant potential upside not captured in the current valuation.

The next Donlin could be Donlin.

https://www.mining.com/featured-article/ranked-worlds-20-biggest-gold-projects

https://wp-novagold-2024.s3.ca-central-1.amazonaws.com/media/2024/05/S-K-1300.pdf